Great versus bad health insurance

Let’s talk how to get great health insurance. We will start with the best Medicare configuration for 65+. Look out for the seniors in your life, whether that is yourself or your parents or other seniors you care about.

We will also talk about getting great insurance as non-seniors.

These recommendations are opinionated because anything of lower quality will eventually harm your health. A health insurance policy will show its true value in worst-case scenarios. Comparing two policies of the same tier, for example, “gold” policies that should cover 80% of medical costs, the better policy will offer access to more top doctors and not interfere when you see those doctors.

The best Medicare configuration

The best configuration is Original Medicare + Part D + Medigap supplemental insurance

When: The best time to get setup is when someone turns 65 during a 7-month window that begins 3 months before the 65th birthday and ends 3 months after. Mark your calendars for this important initial enrollment period for when the seniors in your life turn 65. The 65th birthday is the best time to buy Medigap.

The second best time to get setup is Oct 15-Dec 7 for coverage beginning Jan 1. Mark your calendars for Oct 15 to check in on your seniors.

What: Original Medicare is Part A (aka inpatient or hospital care) and Part B (aka outpatient care). Part B generally covers 80% of outpatient services. Part A + Part B are really awesome because they are like a “gold” tier PPO with almost all doctors in-network, all at a fraction of what it should cost on the open market.

Part D is prescription drug plan. There is a small penalty if you are on Original Medicare without Part D. Might as well just get it. The monthly premium for Part D is inexpensive.

Medigap is optional insurance that can cover much of the remaining 20% not covered by Part B. There are many kinds of Medigap, like Plan A through N. Plan, not Part, and yes these names are confusing. The best Medigap plan is Plan G because it covers the most things. (You might see Plan F referred to as the best, but F is being phased out, and F and G are very similar.) There are lots of companies that sell Medigap. After a bit of shopping for Medigap on medicare.gov, I decided to find a health insurance agent to help me make the right choice.

The monthly cost of Original Medicare + Part D + Medigap Plan G is in the ballpark of $400. For most seniors, Part A is free and Part B is $148.50/month in 2021. Basic Part D plans cost less than $30/month. I have seen Medigap Plan G range from $180 to $270.

Do not cheap out. The best Medicare configuration is worth the ballpark $400/month.

You can also get vision and dental coverage from your Medigap insurer.

Avoid: Do not get Part C aka Medicare Advantage. Most of these are HMO plans. Many of them cost $0, not counting the $148.50/month for Part B, and $0 seems like a bargain. But when covered by one of these plans, you lose direct access to your Part A and Part B.

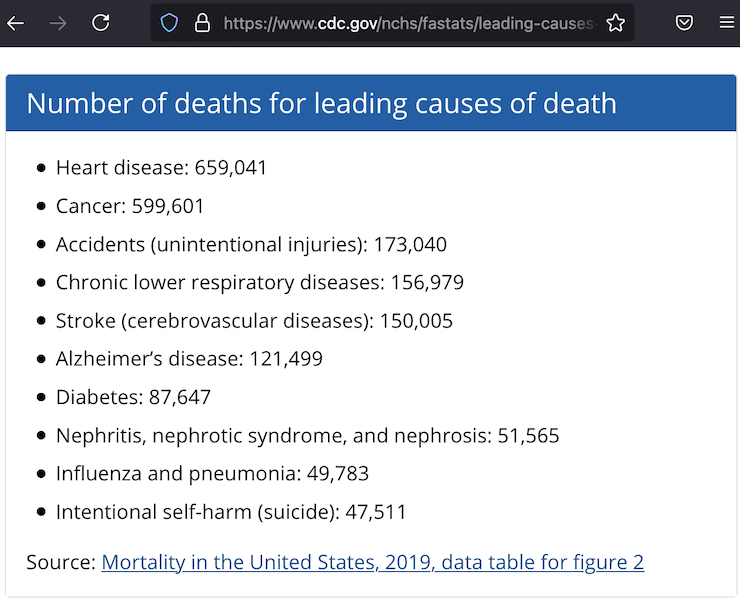

Heart disease and cancer are the leading causes of death. These are the kinds of ailments for which you want the right health insurance so you can access the best care as soon as possible. With Medicare Advantage, a patient can expect to be denied from appointments with the best hospitals and doctors, directed to other hospitals chosen by the HMO, and delayed every step of the way. One or two weeks of administrative delay seems to be common. No American senior should be on any Medicare Advantage plan.

Many websites try to be fair and balanced about Original Medicare versus Medicare Advantage, like medicare.gov talking about perks like gym memberships, and Healthline and AARP and eHealth listing pros and cons. That’s all noise. Be opinionated and avoid letting a corporate middleman make your medical decisions.

How: The steps for getting Part A and Part B are well defined. The Medicare website can be used to shop for Medigap and Part D. I decided to buy through an agent, calhealth.net, whom I recommend for policies in California. Health insurance is state-specific. If I were shopping for health insurance outside of California, I would search for an agent whose analysis of Medicare and Medigap is similar to mine, and avoid the agents trying to sell Part C plans.

Tech help: Assuming your seniors are not as internet-savvy as you are, help them create accounts on ssa.gov and medicare.gov. It may be helpful to have those accounts ready to use.

Also, help your seniors get their medical records by creating accounts with the hospitals they visit. If there are important scans (CT/MRI/X-ray/etc), you can request a CD-ROM of those scans in DICOM file format. These records are useful for seeing other doctors and switching hospitals.

If you receive a major diagnosis while on a Medicare Advantage: Drop your Medicare Advantage plan and switch to Original Medicare.

“I moved to a new address that isn’t in my plan’s service area” is a special circumstance that can make this happen. Medicare Advantage HMOs are regional. On https://www.medicare.gov/plan-compare/#/questions, you can enter the zip code of where you are considering moving to see whether a Medicare Advantage HMO operates there. Once you move to an address beyond your current HMO’s reach, notify Social Security and the HMO of your address change, and you will be on Original Medicare on the first of the next month.

There are other ways to leave a Medicare Advantage plan. I do not pretend to know them all. In any of these cases, also see above about finding a Medigap plan with vision and dental and a Part D plan.

Another option is to pay out-of-pocket for medical services until you can switch to Original Medicare. When asked for insurance, say “out-of-pocket.” Appointments that would otherwise take weeks to book through an HMO could be available within days.

Picking health insurance from your employer (non-Medicare)

Employers typically offer a mix of HMO and PPO options. Again, be opinionated. Avoid the HMOs and pick a great PPO. You care about your health and a HMO cares about finances, which is the very definition of misaligned incentives.

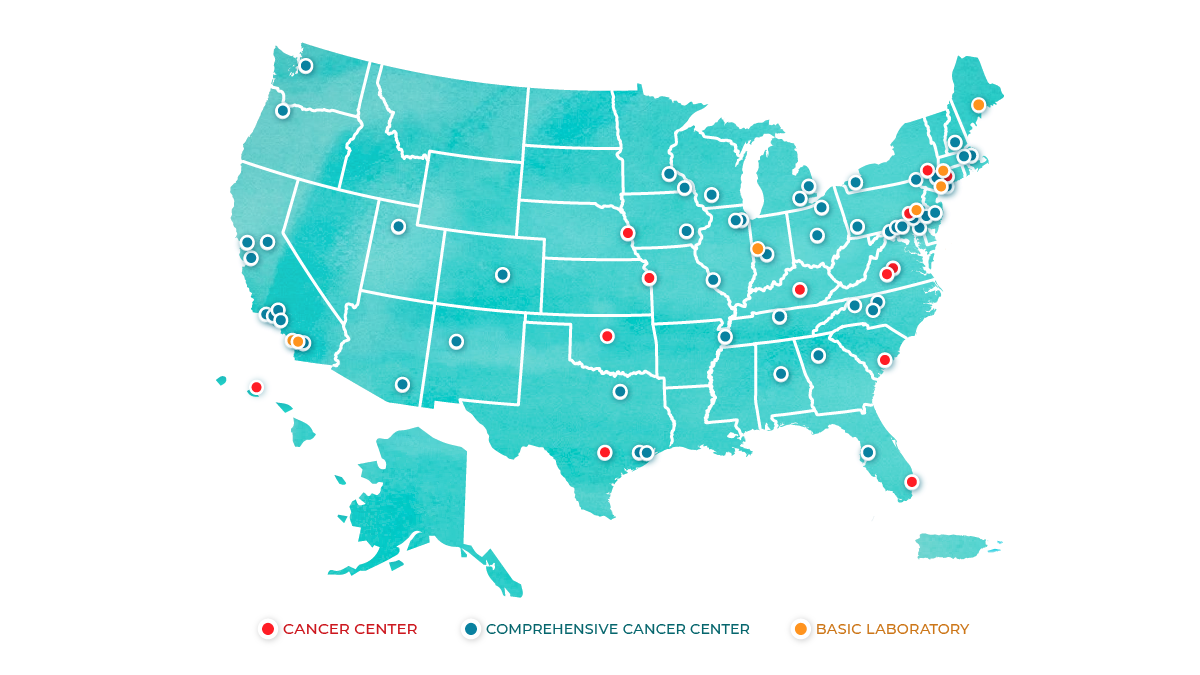

To pick a great PPO, check the best hospitals in your region and see which employer-sponsored PPOs they accept. One view of the best hospitals is the list of NCI-designated cancer centers. Another view is US News rankings for cardiology. In the SF Bay Area, the best hospitals are Stanford Hospital and UCSF Medical Center.

Pick the PPO that gives you access to all of the top hospitals near you. Note that not all states have a top hospital. If your job does not offer you a great PPO, urge your company to change its benefits. Find a new job if you have to. It is worth it.

Buying health insurance on your own (non-Medicare)

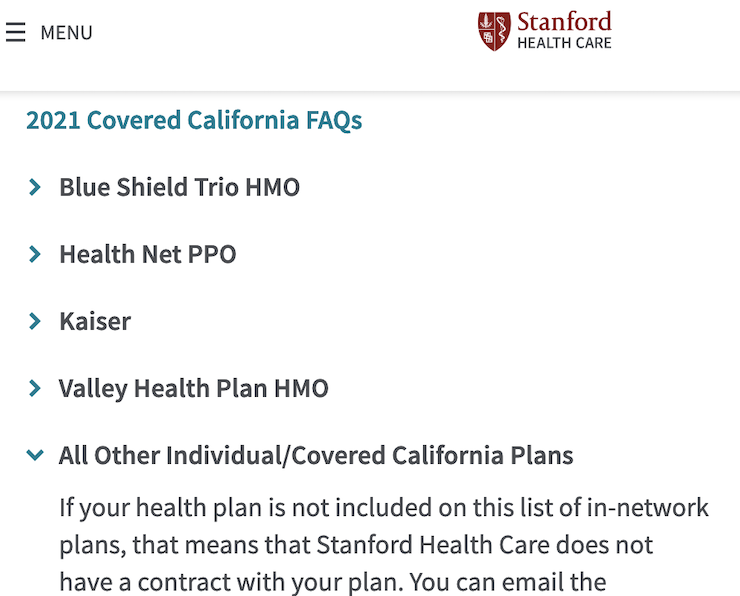

The PPOs on Health Insurance Marketplace (healthcare.gov) are not as good as employer-sponsored plans. Many hospitals list the employer-sponsored plans they accept and also the individual plans they accept, and the list of individual plans is usually shorter. For example, Stanford Hospital in 2021 accepts one PPO that is not even sold on the Marketplace (one I do not like) and a few HMOs (and I refuse to be on an HMO).

So, what to do?

Because small group plans are employer-sponsored plans, they are accepted by more top hospitals, which makes them better than what you can buy on the Marketplace. To buy a small group plan as an individual, you essentially have to setup a business and hire yourself as an employee, and meet other requirements from insurance companies. I have seen requirements about having at least two employees who are not married to each other. Figuring this out is a situation in which a good health insurance agent can provide a lot of value.

How bad can bad insurance be

Thanks if you’re still reading. Hope this is helpful.

I have personally seen Optum cancel two oncologist appointments within the same week without notifying the patient. In both cases, friendly customer-facing employees of Optum had booked the appointments, and those appointments were canceled by other employees whose names I never learned. Optum was the face of the Medicare Advantage HMO.

I have a feeling that the best hospitals in the US are the best in the world, and that the average US hospitals are the worst of the developed world. I got to know an average US hospital, one that was assigned by the HMO. Doctors were mostly unreachable. An unhelpful pathology analysis basically said, “the tissue sample is a sample of tissue.” Nurses gave tips on how to deal with the HMO… “call everyday.”

At a top hospital, every interaction was 5-stars would definitely recommend.